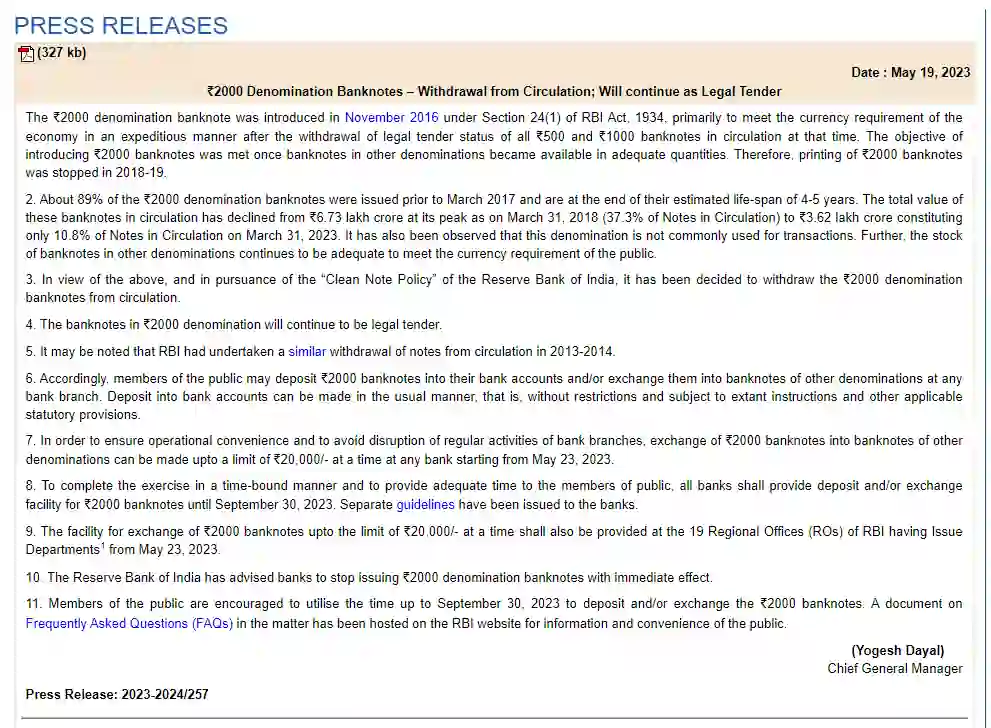

Rupee 2000 Note Ban In India: On Friday, May 19, The Reserve Bank of India (RBI) announced the withdrawal of Rupee 2000 currency notes from circulation. However, it will continue to be a legal tender.

Rupee 2000 Note Ban In India – Press Releases

The RBI has stated this by an official press release and the release number for this announcement by the RBI was 2023-2024/257.

This decision Of RBI has raised many questions and sparked discussion among people worldwide. But the RBI assured that people could use ₹2000 notes for their payments and transactions; also, they can receive them in payment. The RBI told banks to stop issuing the ₹2000 note immediately.

Under Section 24(1) of the RBI Act, 1934, The RBI introduced the ₹2000 notes in November 2016 to fulfill the currency requirement of the economy expeditiously after the withdrawal of the notes of ₹500 and ₹1000 that are in the legal tender status in circulation at that time.

In 2018-19, the printing of ₹2000 banknotes was stopped once the fulfillment of purpose, and there were enough banknotes in other denominations available. Most of the ₹2000 notes were issued before March 2017 and are nearing their estimated life span of 4-5 years.

As of March 31, 2018, the banknotes in circulation value at ₹6.73 lakh crore, which accounted for 37.3% of all notes in circulation. However, by March 31, 2023, the total value of these banknotes decreased to ₹3.62 lakh crore, making up only 10.8% of all notes in circulation.

Moreover, this denomination is not regularly used for transactions. The statement also mentioned enough banknotes in other denominations to meet the public’s currency needs.

The RBI said people could deposit or exchange ₹2000 notes before September 30, 2023. The facility of exchanging or depositing into an account of ₹2000 notes will be available till September 30, 2023, at any bank branch in a usual manner, that is, and without any restrictions.

The People can exchange their ₹2000 notes for another note at a limit of ₹20,000/- at a time at any branch of the bank. The ₹20,000/- exchange notes facility starts on May 23, 2023. The facility for the exchange of ₹2000 notes shall also be provided at the 19 Regional Offices (ROs) of RBI having Issue Departments.

Separate guidelines have been issued to the banks.

Guidelines Issued By RBI

The RBI announced to withdraw the ₹2000 notes from circulation, which will remain legal tender. According to the implementation of this decision, the following action has been formulated for the banks that they must follow.

- All banks are required to stop issuing ₹2000 denomination banknotes immediately. ATMs and Cash Recyclers should also be adjusted accordingly to reflect this change.

- If a bank holds a Currency Chest (CC), they must restrict withdrawals of ₹2000 denomination from the CCs.

- The facility of exchanging and deposit of ₹2000 notes will be available for anyone up to September 30, 2023.

- You can deposit your ₹2000 notes into accounts maintained with all banks can be made as usual.

- All the banks can exchange ₹2000 notes up to a limit of ₹20,000/- at a time.

- The People can start exchanging or depositing their ₹2000 notes from May 23, 2023

- Banks may consider using mobile vans to provide deposit or exchange facilities to people residing in remote or unbanked areas.

- Banks will make special arrangements for senior citizens or persons with disabilities to ease the inconvenience of exchanging or depositing Rs 2000 notes.

- The ₹2000 notes will continue to be legal tender.

- Banks can also advise people suitably in this matter.

All the instructions will be effective until 30 September 2023.